Today the German Federal Statistical Office (Destatis) published a press release on agreed earnings in Germany and in France in 2014 which perfectly demonstrates how even institutions supposed to give pertinent information are missguide their readers on developments in the European Monetary Union (EMU) and the core behind the Euro crisis. However, it motivates to get things right once again.

The heading of the press release is clear: “Increase in agreed earnings in 2014 much stronger in Germany than in France”. And so it is its supposed intention: Germany has been criticised for not keeping wage development in accordance with productivity development. Since this relation determines prices the result would have been a real devaluation against other EMU member countries making Germany more competitive. Moreover, since wages are the by far biggest aggregate in domestic demand this would have led to insufficient domestic demand supporting the high German export surplus and the high trade and current account deficits – in other words increasing debt – for other EMU member countries as well as for the rest of the world (see also here on the most recent critique of the U.S. treasury).

Thus, it is only consequent that Destatis refers in its press release to inflation, too:

“The Federal Statistical Office (Destatis) also reports that – based on the Harmonised Index of Consumer Prices – consumer prices rose more strongly in Germany (+0.8%) than in France (+0.6%) in 2014 compared with 2013.”

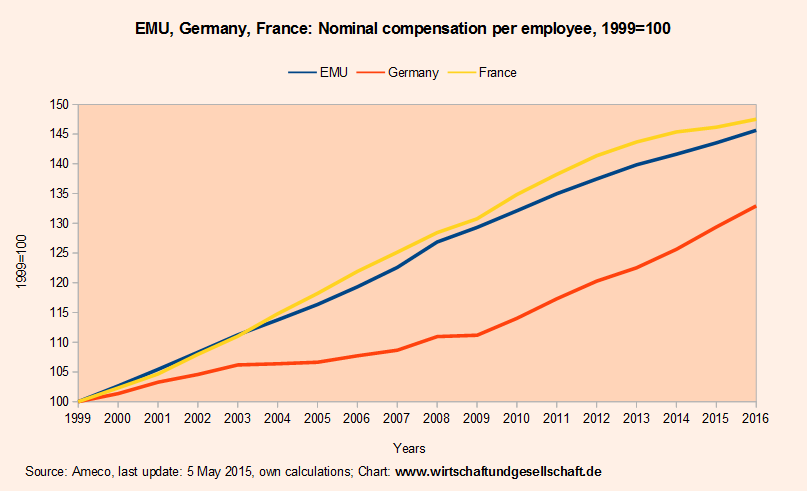

So, is everything fine now with German wage development and the inflation rate? Unfortunately it is not. Since the EMU does not exist since 2014 but since 1999 the only way to get things right is to go back to 1999 and follow the development since then. Here it is:

Wage development in Germany has been over a long period far below the EMU as a whole and far below that in France. This has led to a big wage gap between Germany, France and the EMU as a whole. Interesting to see, too, that the projections of the EU Commission for the years 2015 and 2016 assume that there will be practically no adjustment in the near future. Against this background and its consequences – weak domestic demand in Germany and a persistently high German export surplus (exporting unemployment to those trading partners, too!) – it is hard to believe that German journalists and politicians are fond of naming Germany an engine of growth (“Konjunkturlokomotive”). We have questioned and criticised this since years in many articles.

Even more relevant, however, is the relation between the development of wages and productivity since it is to a high degree responsible for the development of prices and therefore the competetiveness. In the statistic this relationship is expressed in nominal unit labour costs.

As the chart shows, the development of nominal unit labour costs in Germany has been again far below the development in the EMU as a whole and in France. Moreover, whereas France until recently sticked to the inflation target of the ECB, Germany did not. However, the projections of the EU Commission for the years 2015 and 2016 don´t expect a relevant adjustment from Germany, but from France! That this doesn´t ring a bell for the French government is part of the problem of the Euro crisis. Instead of criticising Germany for breaking the common inflation rule they now try to follow the German Agenda 2010, in other words practicing austerity (cutting government expenses, suppressing wages and removing employment rights).

The development of the Harmonised Consumer Price Index (HCPI) which is the guideline for the inflation target of the ECB present a similar picture. And again, the projections of the EU commission for the years 2015 and 2016 signal that it is upon France to adjust not upon Germany. Taking again the inflation target of the ECB into consideration (green line) this means a clear violation of this commonly agreed and most important rule of the EMU.

Every responsible politician, journalist, economist and convinced European should discuss this and put it a the top of any agenda to save the Euro. However, this is not at all the case. Without naming and overcoming this problem, however, it will hardly be possible to overcome the most urgent problem in the EMU: the unbearable high incidence of unemployment.

Dieser Text ist mir etwas wert

|

|